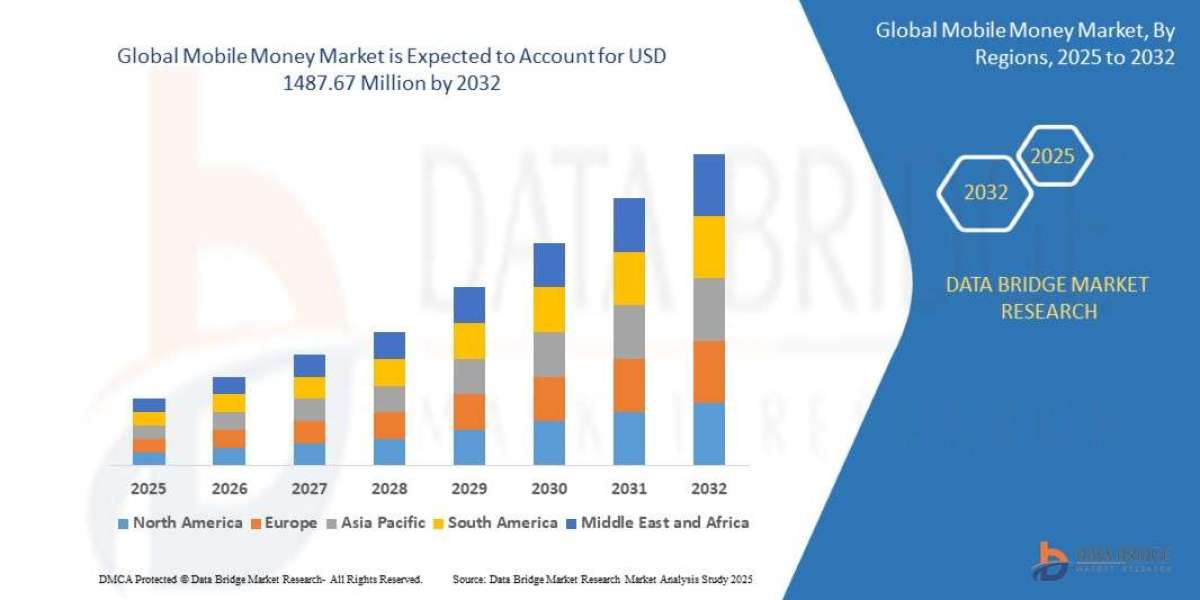

"Key Drivers Impacting Executive Summary Mobile Money Market Size and Share

CAGR Value :

- The global mobile money market was valued at USD 139.73 million in 2024 and is expected to reach USD 1487.67 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 34.40%.

Analysis and discussion of important industry trends, market size, market share estimates are also covered in this global Mobile Money Market report. The usefulness of SWOT analysis and Porter's Five Forces analysis in generating market research report makes it preferable by the businesses and hence also used while preparing this Mobile Money Market report. Mobile Money Market report consists of market analysis by regions, especially North America, China, Europe, Southeast Asia, Japan, and India, focusing top manufacturers in global market, with production, price, revenue, and market share for each manufacturer. Being the most suitable example of the key market attributes, this Mobile Money Market report has been prepared by keeping in mind every market related aspect.

Mobile Money Market report provides statistics on the current state of the industry and thereby acts as a valuable source of guidance and direction for companies and investors interested in this market. Each of the topics is researched and analysed in depth for generating comprehensive Mobile Money Market research report. This Mobile Money Market report examines the market with respect to general market conditions, market status, market improvement, key developments, cost and profit of the specified market regions, position and comparative pricing between major players. Mobile Money Market report is an absolute background analysis of the Mobile Money Market industry which includes an assessment of the parental market.

Understand market developments, risks, and growth potential in our Mobile Money Market study. Get the full report:

https://www.databridgemarketresearch.com/reports/global-mobile-money-market

Mobile Money Industry Trends

**Segments**

- By Transaction Mode: NFC, QR Code, SMS, STK/USSD

- By Nature of Payment: Person-to-person, Person-to-Business, Business-to-Person, Business-to-Business

- By Location: Domestic, International

- By Type of Purchase: Airtime Transfer & Top-Ups, Money Transfers & Payments, Merchandise & Coupons, Travel & Ticketing

The global mobile money market is segmented based on various factors which play a crucial role in shaping the industry landscape. The transaction mode segment includes NFC, QR Code, SMS, and STK/USSD options, providing users with multiple choices for conducting transactions. The nature of payment segment categorizes mobile money usage into person-to-person, person-to-business, business-to-person, and business-to-business transactions, showcasing the diverse applications of mobile money in different scenarios. The location segment divides the market into domestic and international sectors, reflecting the global reach of mobile money services. Lastly, the type of purchase segment includes airtime transfer & top-ups, money transfers & payments, merchandise & coupons, and travel & ticketing options, illustrating the wide range of activities that can be facilitated through mobile money platforms.

**Market Players**

- Vodafone Group Plc

- Orange SA

- Safaricom

- Airtel

- MTN Group

- PayPal Holdings Inc.

- Mastercard

- Google LLC

- Apple Inc.

- Samsung Electronics Co. Ltd.

The global mobile money market boasts a competitive landscape with several key players driving innovation and growth in the industry. Companies such as Vodafone Group Plc, Orange SA, Safaricom, and Airtel have established themselves as prominent players in providing mobile money services to consumers around the world. Additionally, multinational corporations like MTN Group, PayPal Holdings Inc., Mastercard, Google LLC, Apple Inc., and Samsung Electronics Co. Ltd. have also entered the mobile money market, leveraging their expertise and resources to enhance the mobile payment ecosystem. These market players are continuously investing in research and development to introduce new features and services that cater to the evolving needs of mobile money users.

The global mobile money market is witnessing significant growth and transformation driven by technological advancements, changing consumer preferences, and a growing shift towards digital payment solutions. One key trend shaping the market is the increasing adoption of mobile wallets and payment apps, offering convenience, security, and seamless transactions for users across various industries. With the rise of smartphone penetration and internet connectivity, mobile money services have become more accessible to a wider population, especially in emerging markets where traditional banking infrastructure may be limited. As a result, mobile money platforms are not only serving as payment solutions but also as tools for financial inclusion, enabling underserved populations to participate in the digital economy and access financial services.

Another notable trend in the mobile money market is the integration of additional services and features within mobile payment apps, such as bill payments, insurance, savings, and investment options. This diversification of offerings has expanded the utility of mobile money platforms beyond basic transactions, making them more versatile and appealing to a broader range of users. Market players are increasingly focusing on creating a seamless and holistic financial ecosystem within their mobile money apps, aiming to capture a larger share of the consumer wallet and drive user engagement and loyalty.

Moreover, the partnership and collaboration landscape within the mobile money market are evolving, with companies forming strategic alliances to expand their reach, enhance customer experience, and tap into new revenue streams. Collaborations between mobile network operators, financial institutions, technology companies, and e-commerce platforms are becoming more prevalent, leading to the creation of integrated ecosystems that offer end-to-end financial solutions to users. These partnerships not only drive innovation and differentiation but also enable market players to leverage each other's strengths and capabilities to deliver value-added services to customers.

Furthermore, regulatory developments and government initiatives are playing a crucial role in shaping the direction of the mobile money market. Regulatory bodies are implementing frameworks to ensure consumer protection, data security, and interoperability within mobile payment systems, fostering trust and confidence among users. Government-led initiatives to promote cashless transactions and digital financial literacy are also contributing to the growth of the mobile money market, as policymakers recognize the potential of mobile payments to drive economic growth, financial inclusion, and financial stability.

In conclusion, the global mobile money market is experiencing rapid evolution and expansion, driven by technological innovations, changing consumer behaviors, strategic partnerships, and regulatory support. As mobile money services continue to penetrate new markets and offer a wider range of financial products and services, the industry is poised for further growth and innovation, creating opportunities for market players to capitalize on the increasing demand for convenient, secure, and efficient digital payment solutions.The global mobile money market is undergoing a significant transformation driven by the increasing adoption of mobile wallets and payment apps, offering convenience and security to users worldwide. Mobile money platforms are not only serving as payment solutions but also as tools for financial inclusion, allowing underserved populations to access digital financial services. As smartphone penetration and internet connectivity rise, mobile money services are becoming more accessible, particularly in emerging markets where traditional banking infrastructure may be lacking. This trend is reshaping how people conduct transactions, manage their finances, and participate in the digital economy.

In addition to basic transactions, mobile money apps are diversifying their offerings by integrating additional services such as bill payments, insurance, savings, and investment options. This diversification enhances the utility of mobile money platforms, making them more versatile and appealing to a broader user base. Market players are focusing on creating holistic financial ecosystems within their apps to capture a larger share of the consumer wallet and drive user engagement. By offering a wide range of services beyond traditional payments, mobile money providers are positioning themselves as one-stop financial solution providers for users.

Partnerships and collaborations are also shaping the mobile money market, with companies forming strategic alliances to expand their reach, enhance customer experience, and drive revenue growth. These partnerships create integrated ecosystems that offer end-to-end financial solutions to users, driving innovation and differentiation in the market. By leveraging each other's strengths and capabilities, market players are able to deliver value-added services to customers and stay ahead of the competition. As the market continues to evolve, we can expect more collaborations between mobile network operators, financial institutions, technology companies, and e-commerce platforms to enhance the overall mobile money experience for users.

Regulatory developments and government initiatives are significant factors influencing the mobile money market, with regulators implementing frameworks to ensure consumer protection, data security, and interoperability within mobile payment systems. Government-led initiatives to promote cashless transactions and digital financial literacy are further driving the growth of the mobile money market. These initiatives recognize the potential of mobile payments to foster economic growth, financial inclusion, and financial stability, positioning mobile money as a key driver of digital financial transformation globally.

To conclude, the global mobile money market is poised for continued growth and innovation, propelled by technological advancements, changing consumer preferences, strategic partnerships, and regulatory support. As mobile money services evolve to meet the diverse needs of users and offer a broader range of financial products and services, the industry presents significant opportunities for market players to capitalize on the rising demand for secure, convenient, and efficient digital payment solutions.

Break down the firm’s market footprint

https://www.databridgemarketresearch.com/reports/global-mobile-money-market/companies

Mobile Money Market Reporting Toolkit: Custom Question Bunches

- What is the total valuation of the Mobile Money industry this year?

- What will be the future growth outlook of the Mobile Money Market?

- What are the foundational segments discussed in the Mobile Money Market report?

- Who are the dominant players in Mobile Money Market each region?

- What countries are highlighted in terms of revenue growth for Mobile Money Market?

- What company profiles are included in the Mobile Money Market report?

Browse More Reports:

Global Intelligent Power Distribution Unit (PDU) Market

North America Surgical Power Tools Market

Global Non-Invasive Cancer Diagnostics Market

Global Cerebral Vasospasm Market

Middle East and Africa Diet and Nutrition Apps Market

Asia-Pacific Polyimide Films Market

Global Offshore Drilling Market

Global Paragonimiasis Treatment Market

Middle East and Africa Surgical Power tools Market

Europe Sustainable Aviation Fuel Market

Global Cardiovascular Ultrasound System Market

Global Uterine Polyps Drug Market

Global Dental Consumables Market

Global Amusement Parks Market

Global Polyurethane Additives Market

Global Bottled Cocktail Market

Global Self-Adhesive Tear Tape Market

Global Nursing and Residential Care Market

Global Titanium Dioxide Market

Europe Biopreservation Market

Asia-Pacific Personal Care Ingredients Market

Global Yeast Infection Market

Asia-Pacific Unmanned Ground Vehicle Market

Global Shale Gas Processing Equipment Market

Global Veterinary Blood Lactate Test Meter Equipment Market

Asia-Pacific Commercial Cleaning Equipment Market

Asia-Pacific Retail Analytics Market

Europe Weight Loss and Obesity Management Market

North America Biopreservation Market

Global Automotive Emission Test Equipment Market

North America Hydrographic Survey Equipment Market

Europe Cooling System for Edge Computing Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]

"